{archive_title}

Category: Strategy Development

-

Testing a YouTube-Sourced Trading Idea in the Futures Markets

Introduction: In the vast landscape of trading, inspiration can emerge from a multitude of sources – books, courses, forums, and the digital realm of YouTube, Discord, and beyond. The latter, in particular, hosts a myriad of channels unveiling trading strategies across Forex, Crypto, Futures, Stocks, and more. These platforms often showcase strategies through visual aids…

-

Enhancing the 2-Period RSI2 on Indexes Using the VIX Futures Market – an RSI trading strategy

Introduction In the book “Short Term Trading Strategies That Work” by Larry Connors and Cesar Alvarez, a widely used entry strategy for Index markets is discussed, which takes advantage of the index mean reversion edge through the 2-period RSI. This RSI trading strategy involves going long only when the 2-period RSI falls below an oversold…

-

Introducing Tradesq Seasonal Edges – free trading system givaway

In the dynamic world of trading, staying ahead of the game requires constant innovation and adaptability. We are thrilled to show you an exciting new feature in Tradesq — Seasonality Edges. As our recent blog post mentioned, Tradesq has introduced a powerful tool that takes advantage of seasonal trends and patterns to enhance your trading…

-

Best Seasonal Trading Strategies – Part 2

Introduction Welcome back to the Seasonal Trading Strategies – Part 2 series! In our previous blog post, we embarked on a journey to explore the fascinating concept of seasonality in trading. We laid the foundation by introducing and defining what seasonal trading is and delved into how it can provide valuable insights for traders. If…

-

Seasonality in Trading – Unveiling the Super Power of Seasonality

Welcome to the first installment of our new blog series on seasonality in trading. In this series, we’ll be exploring the concept of seasonality and how traders can use it to improve their daily strategies. Whether you’re a seasoned pro or just starting out, understanding the patterns and trends that occur throughout the year can…

-

Does the Hammer-Hangman Pattern work on Futures markets?

A Tradesq Case Study I want to see that the simple pattern called Hammer or Hanging man works in future markets, but before beginning the test let’s see what the pattern is all about: Definition: Source https://www.thinkmarkets.com/ How to use it Short trades: Hammer Pattern and Close are higher than the open. Long trades: Hammer Pattern and…

-

Testing a Larry Williams Tradestation system

Larry Williams is a well-known trader and author who has been involved in the financial markets for over 50 years. He is perhaps best known for his successful trading system called “The Ultimate Oscillator,” which uses moving averages and other technical indicators to identify potential trade opportunities. One of the key principles of Williams’ trading…

-

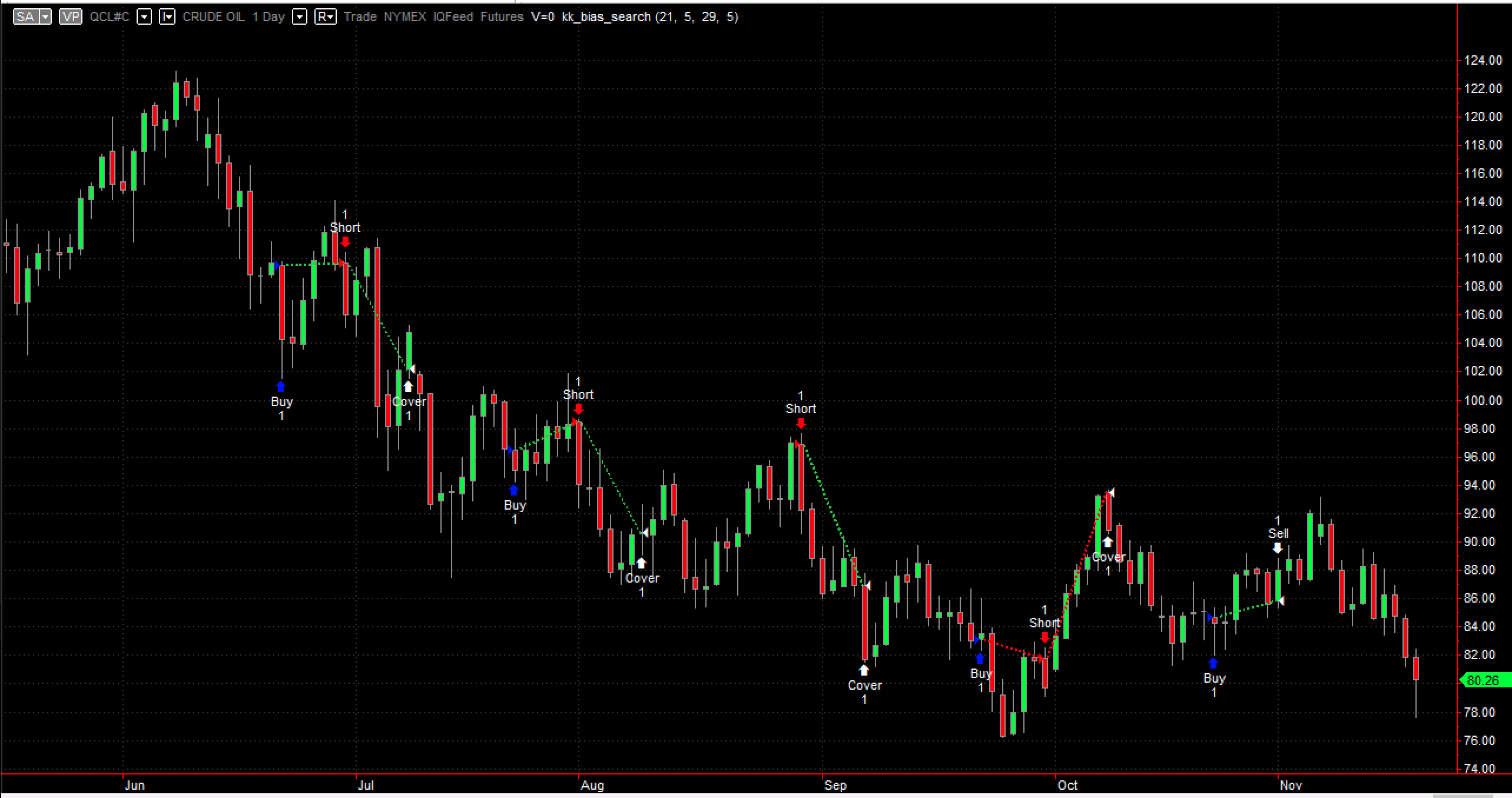

How to develop bias-based strategies in EasyLanguage

The common wisdom of trading strategy development forums and online communities suggests that trading algos can be divided into two major groups: trend-following and mean-reversion-based strategies. Well, this is fundamentally true, but we should not forget about other exciting strategy types as well: Now, let’s stick a little bit with bias-based strategies. This strategy type…