Table of Contents

Introduction:

In the vast landscape of trading, inspiration can emerge from a multitude of sources – books, courses, forums, and the digital realm of YouTube, Discord, and beyond. The latter, in particular, hosts a myriad of channels unveiling trading strategies across Forex, Crypto, Futures, Stocks, and more. These platforms often showcase strategies through visual aids like Trading View, elaborating on entry points, exits, and filters. Yet, amidst this wealth of information, the challenge lies in the lack of comprehensive backtesting, accounting for crucial factors like Slippage, Commissions, and years of historical data. Personally, I find it imperative not to embark on any trading idea without first subjecting it to my own rigorous backtesting. This article centers on precisely that as we delve into a random strategy sourced from YouTube and subject it to rigorous testing in the Futures Markets. My YouTube search for “Futures Trading Strategy” led me to the Trade Pro Channel, capturing my attention with its profitability claim over the past eight years.

It’s a mean reversion strategy with the following entry and exit conditions:

The Strategy

Conditions to go long:

- Price above a 200-exponential moving average.

- Price crosses below a 20-exponential moving average or Price crosses below a 50-exponential moving average.

- RSI 14 is below oversold limit of 20.

Conditions to go short:

- Price below a 200-exponential moving average.

- Price crosses above a 20-exponential moving average, or Price crosses above a 50-exponential moving average.

- RSI 14 is above the overbought limit of 80.

Conditions to exit:

- Profit target 2x Stop loss (No specific number).

Now, I will code and test the strategy and upload it to Tradesq to find out what futures markets the strategy will work.

The research

Software

- Charting Software: TradeStation 10.0.

- Code development language: Easylanguage 10.0.

- Future Markets Research: tradesq.net

Code Considerations

- Option to go long only, short only, or both.

- A profit target bigger or equal to the Stop loss will add a multiplier from a 1:1 ratio to a 2:1 ratio.

- RSI length as an input.

Let’s check if the code is working and how the entries look in TradeStation:

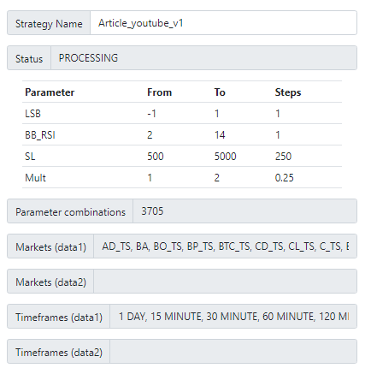

After checking that the code is working correctly, let’s proceed to take it to Tradesq and set the inputs that will vary:

Results

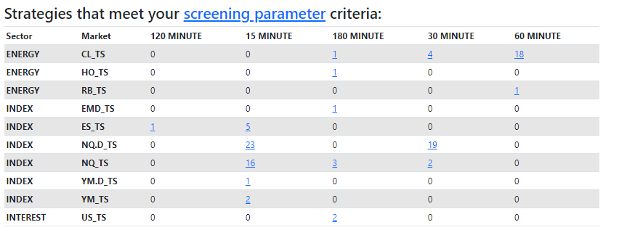

Filtered by strategies with a PNL/DD ratio above 5.0, R2 above 0.5, and more than 200 trades:

Note: All results include trading costs, Slippage and Commission.

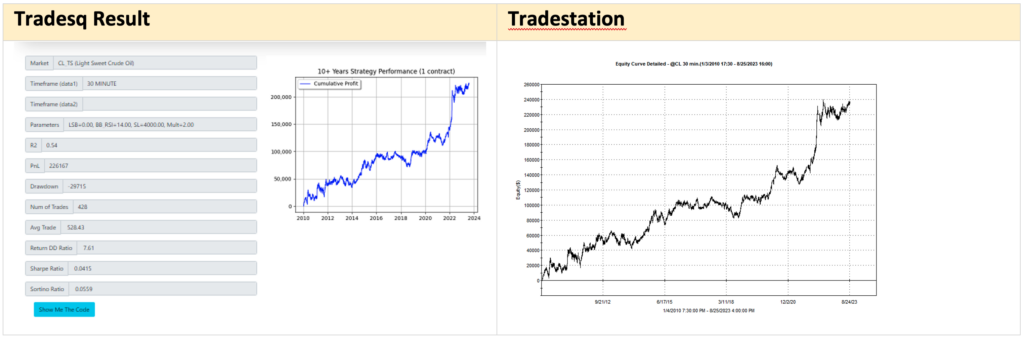

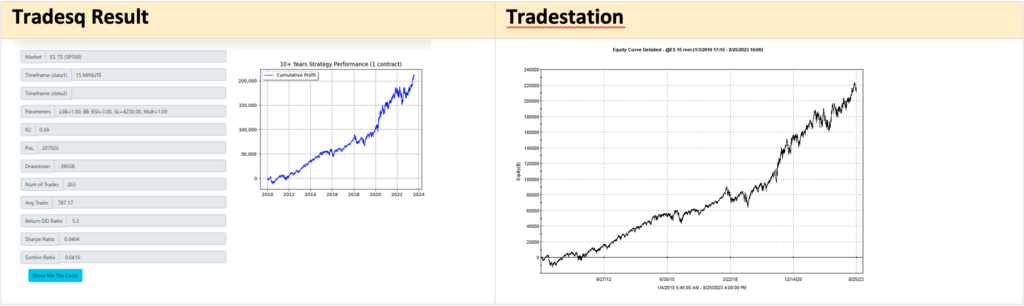

It seems that the strategy works well on Index and Energy futures; let’s see some of those results:

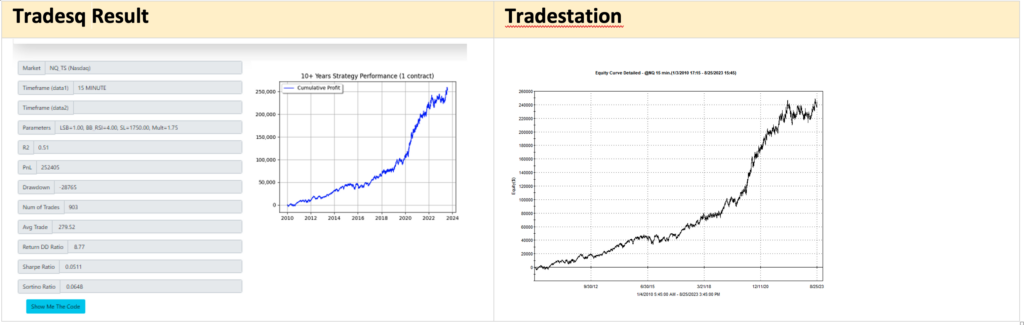

Data: NQ (15min)

Data: CL (60min)

Data: CL (60min)

Conclusion

Our journey through testing a YouTube-sourced trading strategy highlights the indispensable need for thorough validation. The Trade Pro Channel’s seemingly promising eight-year-profitable strategy reminded us that concepts require solid testing before trust. Employing the right tools, like TradeStation, Easylanguage, and Tradesq, revealed market suitability, showing that diligent testing can yield surprises. In the world of trading ideas, it’s the tested ones that deserve our attention – a lesson to always test before you trade.

Author:

Juan Fernando Gómez

Email: jgomezv2@gmail.com

Leave a Reply

You must be logged in to post a comment.