In the dynamic world of trading, staying ahead of the game requires constant innovation and adaptability. We are thrilled to show you an exciting new feature in Tradesq — Seasonality Edges. As our recent blog post mentioned, Tradesq has introduced a powerful tool that takes advantage of seasonal trends and patterns to enhance your trading strategies. With Seasonality Edges, you can unlock valuable insights and gain a competitive edge in the market.

This article will focus on one of the edges listed in Tradesq’s Seasonality Library. Seasonal Edge based free trading system giveaway.

The July 1st ES (S&P 500) long edge

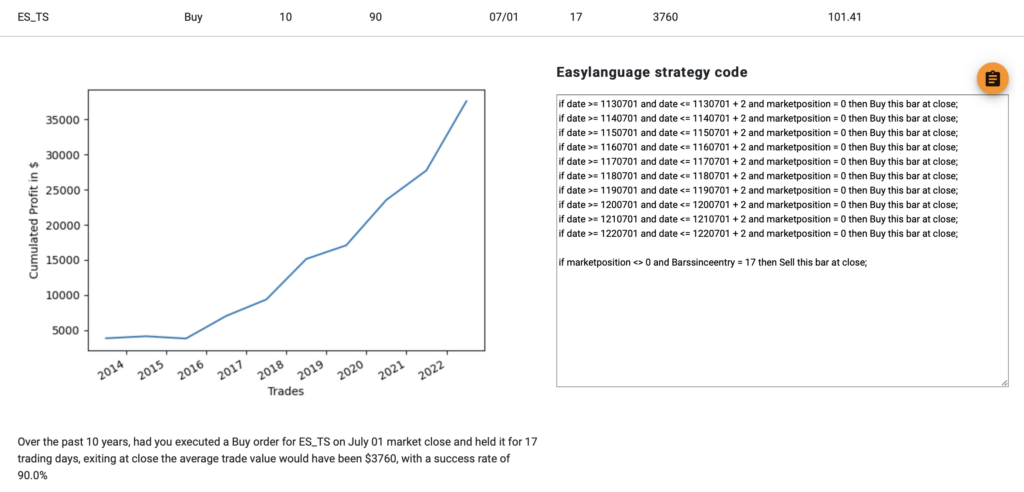

Browsing the Tradesq seasonality database, one of the upcoming edges is an ES (S5P 500) long edge on July 1st:

What does it mean? Analyzing historical time series data for ES, our Seasonality Engine identified a new seasonal edge formed around 2014. This edge signifies a strong statistical bias for S&P500 (and related markets) for a successful long trade.

How to trade this edge? Buy ES (S&P 500) on July 1st at market close. Hold the trade for 17 trading days and exit the position on the close. Doing this will give you a 90% statistical chance of winning the trade. In the past 10 years, trading this edge, traders could average a $3,750 average trade size. This means a total of $37,500 profit during the last decade.

For algo traders, Tradesq offers a generated EasyLanguage code to utilize this edge quantitatively:

Copied!//TO be placed to @ES symbol - free trading system follows if date >= 1130701 and date <= 1130701 + 2 and marketposition = 0 then Buy this bar at close; if date >= 1140701 and date <= 1140701 + 2 and marketposition = 0 then Buy this bar at close; if date >= 1150701 and date <= 1150701 + 2 and marketposition = 0 then Buy this bar at close; if date >= 1160701 and date <= 1160701 + 2 and marketposition = 0 then Buy this bar at close; if date >= 1170701 and date <= 1170701 + 2 and marketposition = 0 then Buy this bar at close; if date >= 1180701 and date <= 1180701 + 2 and marketposition = 0 then Buy this bar at close; if date >= 1190701 and date <= 1190701 + 2 and marketposition = 0 then Buy this bar at close; if date >= 1200701 and date <= 1200701 + 2 and marketposition = 0 then Buy this bar at close; if date >= 1210701 and date <= 1210701 + 2 and marketposition = 0 then Buy this bar at close; if date >= 1220701 and date <= 1220701 + 2 and marketposition = 0 then Buy this bar at close; if marketposition <> 0 and Barssinceentry = 17 then Sell this bar at close;

Multiple ways to trade a seasonality edge

Depending on your trading approach, you can gain an advantage on this edge independently if you are a discretional or quantitative trader.

- You can trade the raw edge: you can enter and exit the trade based on the edge rules without any specific risk management. This reflects a Buy and Hold mentality.

- You might define a breakout (or momentum) type of entry trigger to potentially increase the average win size.

- You can consider introducing risk management by adding Stop Loss or Profit Target rules.

- If you have a well-established trading system for ES, you might increase the position size on July 1st and the coming 17 trading days.

What is next?

Looking beyond the potential of a great trade, the question of what comes next often arises. Luckily, Tradesq has the answer with its remarkable seasonality edges—a secret weapon designed to elevate the Profit Factor of your trades, irrespective of your preferred trading style. With over 700 seasonality edges on various futures symbols housed within Tradesq’s extensive database, similar to the one highlighted in this very article, you gain access to a wealth of valuable insights.

To unlock this vast edge database, all you need to do is subscribe to our monthly or yearly Futures Seasonality package, enabling you to commence trading immediately.

As a special introductory offer, we are thrilled to provide you with the exclusive SEASONAL10 voucher code, granting you a 10% discount on your subscription. Seize this opportunity and harness the power of seasonality to optimize your trading endeavors like never before.

Leave a Reply

You must be logged in to post a comment.