Introduction

Welcome back to the Seasonal Trading Strategies – Part 2 series! In our previous blog post, we embarked on a journey to explore the fascinating concept of seasonality in trading. We laid the foundation by introducing and defining what seasonal trading is and delved into how it can provide valuable insights for traders. If you missed it, we highly recommend giving it a read to grasp the fundamentals.

As we progress further in this series, we will shift our focus to the practical aspect of utilizing seasonality in trading. This article will explore how to uncover those elusive seasonality edges that can potentially enhance our trading strategies. By understanding how to find and exploit seasonality patterns, we aim to equip traders with a powerful tool that can inform their decision-making processes.

As we navigate this exploration, it’s important to remember that seasonality edges are not foolproof predictors of future market behavior. They are merely historical tendencies that may or may not persist in the future. Nevertheless, by combining them with other analytical tools and prudent risk management strategies, traders can gain valuable insights and potentially improve their trading outcomes.

So, without further ado, let’s embark on the quest to uncover seasonality edges and harness their potential in trading. By the end of this article, you will have a comprehensive understanding of the techniques and approaches that can assist you in identifying and leveraging these patterns effectively.

Table of Contents

Finding seasonal trading strategies using data science tools

Identifying seasonality edges in time series data is a challenging task. It is more like a data science project than a trading strategy development assignment.

One effective method is to use time series analysis to identify seasonal patterns in the data. This involves breaking down the data into its component parts, including trend, seasonality, and noise. By isolating the seasonal component, we can identify recurring patterns that are specific to certain times of the year.

Another approach is to use machine learning algorithms to predict future market trends based on historical data. These algorithms can be trained to recognize seasonal patterns and use them to make predictions about future market movements. This can be a powerful tool for traders looking to capitalize on seasonality trends.

Finding seasonality edges using Tradesq

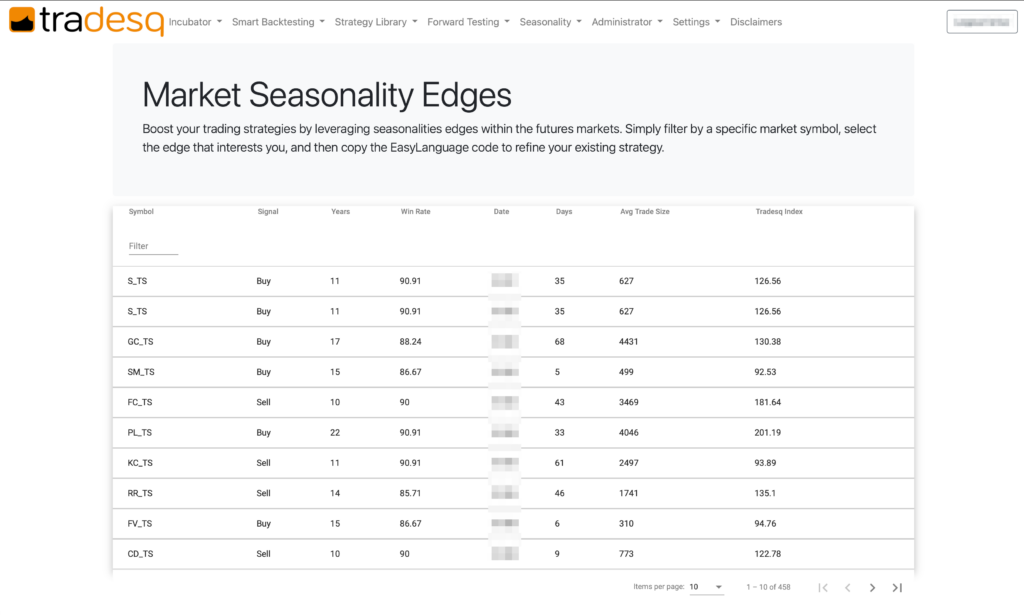

Tradesq offers a comprehensive software solution for trading strategy development, monitoring, and evaluation. A recent enhancement to this platform is the introduction of the Market Seasonality Edges module.

With the Market Seasonality Edges module, traders gain access to a continuous monitoring system that analyzes numerous future markets across various sectors. This module identifies and tracks seasonality edges (seasonal trading strategies) that emerge over time. As of the time of writing, over 450 distinct edges have been identified for futures symbols.

Traders using Tradesq can conveniently view and explore these identified edges. They have the flexibility to list the edges by specific markets or by periods. This feature enables traders to effectively leverage the insights from seasonality analysis to inform their trading strategies.

Example seasonality edge

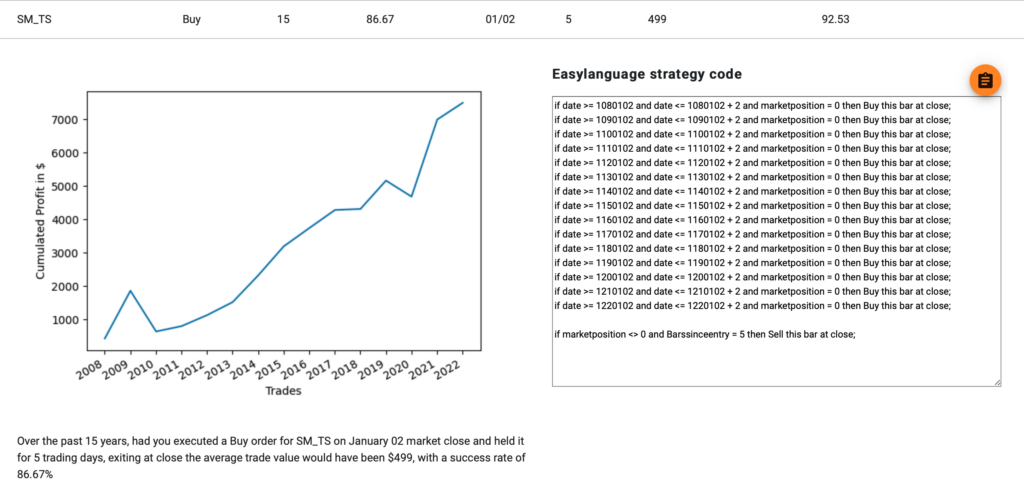

Now, let’s take a look at an illustrative seasonality edge sourced from the database. We have randomly selected a seasonality edge from the Soybean Meal (SM) market to showcase.

As seen in Tradesq, this specific edge has been in existence for the past 15 years and is associated with a trading system that boasts an impressive 86% win rate. Considering its longevity, a trading system aligned with this edge would have executed a total of 15 trades, with an average trade size amounting to $499.

Implementing this trading edge manually is straightforward. Here’s a simple approach: On January 2nd of each year, initiate a long position at market close. Hold the trade for a duration of 5 days and then exit the position at the closing price. By following this strategy, traders can take advantage of the identified seasonality edge effectively.

For the convenience of the quantitative strategy trader, this edge is built as an Easylanguage strategy. This code can easily be pasted to Tradestation or Multicharts over Soybean Meal (@SM) daily chart:

if date >= 1080102 and date <= 1080102 + 2 and marketposition = 0 then Buy this bar at close;

if date >= 1090102 and date <= 1090102 + 2 and marketposition = 0 then Buy this bar at close;

if date >= 1100102 and date <= 1100102 + 2 and marketposition = 0 then Buy this bar at close;

if date >= 1110102 and date <= 1110102 + 2 and marketposition = 0 then Buy this bar at close;

if date >= 1120102 and date <= 1120102 + 2 and marketposition = 0 then Buy this bar at close;

if date >= 1130102 and date <= 1130102 + 2 and marketposition = 0 then Buy this bar at close;

if date >= 1140102 and date <= 1140102 + 2 and marketposition = 0 then Buy this bar at close;

if date >= 1150102 and date <= 1150102 + 2 and marketposition = 0 then Buy this bar at close;

if date >= 1160102 and date <= 1160102 + 2 and marketposition = 0 then Buy this bar at close;

if date >= 1170102 and date <= 1170102 + 2 and marketposition = 0 then Buy this bar at close;

if date >= 1180102 and date <= 1180102 + 2 and marketposition = 0 then Buy this bar at close;

if date >= 1190102 and date <= 1190102 + 2 and marketposition = 0 then Buy this bar at close;

if date >= 1200102 and date <= 1200102 + 2 and marketposition = 0 then Buy this bar at close;

if date >= 1210102 and date <= 1210102 + 2 and marketposition = 0 then Buy this bar at close;

if date >= 1220102 and date <= 1220102 + 2 and marketposition = 0 then Buy this bar at close;

if marketposition <> 0 and Barssinceentry = 5 then Sell this bar at close;If you wonder, seasonality edges are spread relatively evenly during the year. For example, Tradesq’s database contains 38 seasonality-based, statistically proven trading strategies for July.

What is next or seasonal trading?

Thanks to Tradesq, you can access hundreds of seasonality edges in the futures markets. But what is next?

- How can you utilize them if you are a discretional or algo trader?

- What if you trade stocks? Is a stock seasonality screener available to list seasonal patterns in the stock market?

- What is seasonal trading for forex traders? Are there any seasonal trading strategies available for forex pairs?

Stay tuned and follow our blog series about seasonal trading strategies.

Leave a Reply

You must be logged in to post a comment.